Every week I get inquiries on how to rent a property in Calgary. I wanted to write this article in order to help people find the best Calgary rental for their family quickly and with the least amount of stress. There is a lot of competition in the Calgary rental market right now, and it will be getting a lot more difficult to find good places to rent as many people find Calgary an attractive place to live.

The rental rates have recently gone up, but there is still a lot of demand for properties in Calgary. Landlords are getting hundreds of applications and do not have the patience to sort through all of them. They are ignoring applications that give “bad” first impressions, and I am here to show you how to make your application stand out.

Here are 15 useful tips that will help you find the best rental quickly (whether you are trying to rent an apartment in Calgary or rent a house in Calgary or some other type of property) with the least amount of stress. It will require some work and patience on your part, but it will be worth it.

Calgary Rental Guide: How to find a rental in Calgary

1. If you want to find a rental property in Calgary, DO NOT ask a REALTOR for help.

2. Understand your rental costs that you will need to pay for.

3. Scenario 1: Renting an Apartment.

4. Scenario 2: Refugee/New Immigrant Situation: Natasha and Oleksiy from Ukraine are coming with their son and daughter (no credit score and no landlord references).

5. Scenario 3: Renting a House.

6. Calgary’s Top 8 Apartment/House Rental Websites.

7. Get Familiar with rental rates in Calgary, Alberta and budget accordingly (summary of current rental rates)

8. Treat it as if you are looking for a job.

9. Send as many rental applications as you can (BUT KEEP TRACK of those applications).

10. Don’t lie on your application (and more about occupancy standards for each room).

11. Content is everything or how to create a great first impression

12. What to write in your intro email to the landlord. What not to write in your email.

13. Read and understand your lease.

14. What to do after you’ve found your rental (next steps).

15. Tips on how to search on rentfaster.ca.

1. If you want to find a rental property in Calgary, DO NOT ask a REALTOR for help.

Realtors in Calgary typically don’t help people with rentals. It’s just something that’s NOT DONE in Alberta. This practice is quite common in Europe and Eastern Europe, and even in Toronto, Ontario, but in Alberta real estate agents do not work with renters at all.

There are many reasons why Realtors don’t work with renters. It’s not profitable for a real estate agent and can be a major waste of time and, for certain tasks, real estate agents need a separate property management license to handle rentals, which most Realtors do not have.

If a real estate agent doesn’t have a Property Management license, they can get reported to RECA (Real Estate Council of Alberta) and could potentially lose their license (meaning lose their job) or pay a fine of up to $25,000 per property management activity. No Realtor in their right mind is willing to take this risk. All you need to know is that you will need to find a rental property for your family yourself.

In the unlikely event, you do find a Realtor who wants to help you find a rental, they will be charging you at least ONE month’s rent or more as their fee (as some Toronto agents do in Ontario, but note that Toronto rent is MUCH HIGHER than in Calgary, so that’s why the agents in Toronto actually do it).

So if a rental in Calgary is $1750, you will need to pay a real estate agent $1750 as their fee for their rental services, in addition to the landlord’s fees. Landlords in Calgary will NOT pay the real estate agent’s fee.

2. Understand your rental costs that you will need to pay for.

Here are the costs that you will need to pay for in the most typical scenario when renting a property. You will need to have a stable full-time job or multiple part-time jobs or another source of stable income, and positive references about you from your previous landlord(s) located in North America.

- 1-month security/damage deposit (refundable at the end of your lease if you keep the place clean and free of damages)

- The first month of rent

- Utilities – utilities may be included or excluded depending on the rental ad

- If you are renting an apartment: approximately $50-$70 for electricity in an apartment unit; heat (gas) and water are typically included in the condo fee, so the landlord sometimes pays for that; if you need to pay for all the utilities, then you need to account for approximately $200 in your rental budget towards utility payments (which typically include water, sewage, heating/gas, and electricity).

- If you are renting a townhouse/duplex/house: Utilities include water, sewage, heating/gas, and electricity. The cost of utilities is $200-350/month for a property under 1,500 sf) and $450-$700/month for a property over 1,500 sf. $450/month in the summer months (given that you are not running an excessive amount of air conditioning) and $700/month in the cold winter months.

- Internet ($65-89/month). You can use companies like Shaw Internet or Telus Internet and others.

- Moving-in fees (applies only to apartment buildings) to book an elevator (paid to a property management company that manages the apartment complex): $150-$200 fee for each move-in/move-out. If you move in without booking your move, your fine can be expensive ($250-$500 and up) for breaking the rules of the condo complex. The property management company will find out as someone will most likely report you, or there may be a security video recording that will show your actions. There are typically no move-in fees for duplexes, houses, and townhouses.

- Rental Insurance – some landlords require it, and if you want to rent their place, you will need to pay for it. You can get it at Square One, DUUO, Insurely, TD Meloche Monnex, or AMA or any other insurance company. It costs roughly $20-40/month (depends on the type of property you will be renting) and protects your belongings during a fire/flood, etc. It also protects you from liability for negligence (i.e. if you cause a fire or if you forget to turn off the bathtub water and flood the apartment below you). If you are found responsible for the flood, you as a renter will need to pay a $25,000-$50,000 (yes, that’s fifty THOUSAND dollars) deductible fee to the condo board. If you don’t have that money, the landlord can sue you and you will be in trouble. If you have rental insurance, your rental insurance will cover this fee, so that you don’t need to pay for it. If the sprinkler system malfunctions and floods your unit (it happened once in one of the Legacy SE Condo complexes in Calgary), your rental insurance should cover your living costs (in a hotel) and your food costs. I highly recommend it, and most rental/property management agencies require it.

- Pet Costs: if you have a dog/cat/pet, you might need to pay an extra $50-100 per pet per month (all depends on the landlord). Not many landlords accept pets, so be aware of that. Also, most condo buildings/townhouses have a max weight limit for a dog (for example, no more than 30 lbs for a dog) and a max number of pets allowed (for example, only 2 dogs or 1 dog or 1 cat). Most buildings accept small pets like hamsters, guinea pigs, etc, but I’d definitely ask the landlord in advance if that type of pet is okay.

3. Scenario 1: Renting an Apartment.

Mary needs to rent a condo as soon as possible. She is interested in renting an apartment. She is starting a new job soon and has an accepted job offer that includes starting date, salary, and a full-time permanent position. She found a perfect apartment in Legacy for $1650 that she wants to rent for one year. She will still need to pay for electricity and internet. Here is what she will be paying for and the documents she will need to provide.

- $1650 refundable deposit (refundable at the end of her lease if she keeps the place clean and free of damages)

- $1650 first month of rent

- Utilities: $50 for electricity (approximate amount, she needs to register with a utility company under her own name)

- $70 for Internet

- The moving-in one-time fee to move her couch and her bed (she will be using an elevator): $150 fee

- $20 rental insurance/month

- Online Credit Check (some landlords do that; some do not require it – it all depends). Some landlords pay for it and some want you to pay for it ($20). In this case, the landlord is paying for her credit check.

Total Costs for Mary prior to moving in: $3,590

Mary moved in and is enjoying her apartment. Here is what she is paying per month: 1,790/month:

- rent $1650

- electricity $50

- Internet $70

- rental insurance $20

Documents she had to provide with her application:

- a short biography about her and who would be living in the unit (in this example she is living alone)

- her references from her previous landlords

- her job offer/confirmation of her job/position from the HR department of her work

- her credit score if she has it (she checked it for free on CreditKarma.ca or Borrowell.com)

After her application was accepted and the Landlord is ready to sign the lease with her:

- Mary had to read carefully and sign a lease – basically a rental contract that discussed the details of her 1-year FIXED lease with the Landlord

- Mary had to buy rental insurance (companies such as Square One, DUUO, Insurely, TD Meloche Monnex, or AMA)

- Mary had to set up utilities prior to moving in

- Mary had to book an elevator in advance with the property management company and pay for the moving-in fee

- The Landlord and Mary went through the move-in inspection report together

- Mary took pictures of the unit to make sure all the defects were documented and not attributed to her stay in the apartment after one year. The Landlord may or may not also take photos at the same time. She emailed all the pictures to the Landlord before moving into the apartment and saved that email as she will refer back to it in one year to compare the state of her apartment then and one year later.

IMPORTANT NOTE:

- If Mary is unemployed and looking for work and she has no credit rating as she is brand new to Canada, she will need to pay the initial deposit, the first month of rent, the second month, and the last month of rent (that’s 4 payments up front). But not all landlords require this – some are fine with 3 payments – the refundable deposit, the first month and the last month.

- Some landlords also require a bank statement showing that she has enough funds to cover the rent payment during her lease (if Mary doesn’t have a job or has no credit rating/bad credit rating). But not all landlords require this.

- Some landlords will require a credit check of your credit rating (that shows if you’ve ever missed any payments) that you will need to pay for ($20). But not all landlords do this.

- Some landlords also require a bank statement from her country of origin to ensure that she has money if there are not enough funds in her Canadian bank account. But not all landlords require this.

- Some landlords may also require an abstract of her credit score from her previous country of origin. But not all landlords require this.

4. Scenario 2: Refugee/New Immigrant Situation: Natasha and Oleksiy from Ukraine are coming with their son and daughter (no credit score and no landlord references).

Natasha and Oleksiy and their children have just arrived in Canada from Ukraine. They’ve never been to Canada, and do not have an active credit history (no credit cards) or any landlord references, etc. They are starting from zero in a foreign country with minimal English skills and minimal savings.

They are unemployed but eager to look for any type of work. They need to find an affordable place to live as soon as possible. They found a nice 2-bedroom apartment in the SW area on rentfaster.ca for $1500/month + electricity only (heat and water were included in the rental fee).

Here are the costs that they will need to pay for:

- $1500 refundable deposit (refundable at the end of their lease if they keep the place clean and free of damages)

- $1500 first month of rent

- $1500 – for the second month and $1,500 last month of rent (Why? Because they are unemployed and it’s a big risk for a landlord to accept someone without a stable income. Government subsidies help; however, not all landlords feel comfortable with that type of scenario). Sometimes the landlord does not require the second or the last month of rent as they feel sorry for your situation; however, I want you to be prepared for this, as it is a common scenario with Calgary Property Management Companies.

- Proof of Funds (bank statement showing they have funds but they need to remove all their personal info from that statement with a pen or in any Photo Editor Application) – sometimes the landlord requires it and sometimes not

- Utilities: $50 for electricity

- $70 for Internet

- The moving-in one-time fee to move the beds and a couch (they will be using an elevator): $150 fee

- $20 rental insurance/month

Total Costs for Natasha and Oleksiy prior to moving in: $6,290

Natasha and Oleksiy and their children are settling in their new home and here is what they are paying per month:

- $1500 monthly rental fee

- $50/month for electricity

- $70/month for the internet

- $20/month rental insurance

THE TOTAL MONTHLY COST IS $1,640

5. Scenario 3: Renting a House.

Mary and John have expanded their family and are now interested in renting a 1,968 square foot (sf) house in Evergreen, SW, Calgary that’s currently renting out for $2500/month. They are both employed. It’s January and it’s quite cold.

Here are the costs they will need to pay for:

- $2500-1-month deposit (refundable at the end of their lease if they keep the place clean and free of damages)

- $2500 – The first month of rent

- $700/month as it’s in the middle of winter. Utilities include water, sewage, heating/gas, and electricity. The cost of utilities is $200-350/month for a house under 1,500 sf) and $450-$700/month for a house over 1,500 sf. $450/month in the summer months and $700/month in the cold winter months.

- $70/month – Internet

- There are no moving-in fees when it comes to detached houses, semi-detached houses and townhouses (as there are no elevators).

- Rental insurance is highly recommended and may be required by the landlord. This time the landlord didn’t make them purchase rental insurance. Mary and John understand that if their belongings burn down during a fire, they won’t be able to get reimbursement from the landlord, and will most likely have to live with their parents/family members as the landlord WILL NOT pay for their hotel or temporary accommodations. They are willing to take this risk, as they know that in the worst-case scenario, they can move in with their parents, or rent an Airbnb or a hotel for 3 weeks. They know that they can avoid these costs if they have rental insurance, but they are willing to take the risk.

Total Costs for Mary and John prior to moving in: $5,770

Mary and John and their children are enjoying their house and here is what they are paying per month:

- $2500 -monthly rental fee

- $700 for utilities as it’s in the middle of winter; if it was summer, they’d be paying around $350-400/month

- $70/month for the internet

- THE TOTAL MONTHLY COST FOR the month of January (cold winter) is $3,270

- THE TOTAL MONTHLY COST FOR the month of July (warm summer) is $2,920

6. Calgary’s Top 8 Apartment/House Rental Websites.

Here are my Top Calgary Rental websites that will help you rent an apartment or rent a house in Calgary, Alberta:

- rentfaster.ca (my top favourite)

- Kijiji Calgary Rentals

- Boardwalk

- Mainstreet

- Facebook Marketplace (requires an appropriate Facebook profile)

- Rentals.ca

- Emerald Property Management Company

- Unison Property Management

- Power Properties

7. Get Familiar with rental rates in Calgary, Alberta and budget accordingly.

As of January 2023, here are the monthly rental rates you can expect in Calgary (based on my personal experience):

- 1-bedroom apartment: $1,300-$1,500

- 2-bedroom apartment: $1,700-$1,950

- Townhouses: $1,750-$2,000

- Houses with Detached Garages: $1,850-$2,200

- Houses with Attached Garages: $2,200-$2,800

Here is the official average rental data from Rentfaster.ca (from January 2023):

8. Treat it as if you are looking for a job.

When searching for a rental, treat the process as you would a job application. Use a professional email address, such as johnsmith@gmail.com or marysmith@gmail.com, rather than an informal or inappropriate one (no cutiepie036@hotmail.com). Avoid using foreign email domains, like .ru or protonmail.ru, and stick with a reputable provider like Gmail.

In addition to a polished email address, be sure to present yourself in a polite and professional manner in all your communications with potential landlords. A polite and professional approach can make a big difference. The goal is to stand out from the numerous applications the landlord will get.

Before applying, it can be helpful to do a quick search of your name online to see what a landlord might find when they Google you. Make sure that your Facebook/Instagram accounts are appropriate. By standing out from other applicants, you can increase your chances of securing a rental.

9. Send as many rental applications as you can (BUT KEEP TRACK of those applications).

When looking for a rental, it’s important to be proactive and send as many rental applications as you can without losing the quality of your application. That’s why I want you to approach each rental carefully. However, you MUST keep track of these applications.

Keep in mind that not all landlords will respond to your application, as they may receive a large volume of inquiries on a daily basis. To increase your chances of standing out and securing a rental, be sure to carefully read and fully understand the requirements and preferences listed in the rental ad.

When crafting your application, make an effort to mention specific details from the ad that show you have taken the time to thoroughly review it. For example, you might mention that you are excited about the unit’s large size, south-facing orientation, and large balcony with a nice view. By demonstrating your attention to detail and genuine interest in the property, you can increase your chances of getting a positive response from the landlord.

10. Don’t lie on your application.

When filling out a rental application, it’s important to be honest and upfront about who will be living at the property. This includes disclosing any family members, including children and pets, as well as how many people will be living in the unit.

It’s important to note that some landlords may have limits on the number of occupants or may not allow certain types of pets, so it’s best to be transparent about these details from the outset. In addition to that, there is a Calgary bylaw that has a limit on how many people can live in the apartment (for example, a maximum of 2 children per room). According to the National Occupancy Standard (NOS),

- Children under 5 years, either of the same gender or the opposite gender may share a bedroom

- Children under 18 years of the same gender can share a bedroom

- A child aged 5 – 17 years should NOT share a bedroom with a child under 5 of the opposite gender

- Any other household member over 18 years needs to have a separate bedroom

- A person can share a bedroom with their spouse or common-law partner

Additionally, be sure to accurately indicate how many children will be living in each room, as some landlords may have restrictions on the number of children per room. Honesty and transparency on your application can help establish trust with the landlord and increase your chances of being approved for the rental.

11. Content is everything or how to create a great first impression.

- Focus on great first impressions. Check your spelling/grammar and make sure you don’t sound demanding. If you really want to stand out, you can add a nice family picture with this screenshot app in your application – https://snipboard.io/

- If you have a degree or MBA or Ph.D. or if you are a Master’s student, mention that because these details help. They make you look reliable, smart and trustworthy, and make you stand out from other applications.

- Focus on your Content. Not too short and not too long. No excuses, no sob stories – the landlord doesn’t care. All they care about is you paying the rent on time and respecting their property.

- Some people disagree but I recommend that you do NOT mention that you are a refugee or a new immigrant in your application. Some people are scared of unpredictability, so there is no need to mention that in the very first letter. You can tell them about your situation later, or AFTER you meet them in person.

- If you really like a rental and it’s under your budget and there are many competitive tenants, you can offer to pay $100-$200/month more for the rental and see what the landlord says.

- When you meet the landlord in person, make sure that you are on time for your viewing appointment and dress sharp (business casual). If your kids are well-behaved, feel free to bring them with you to meet the landlord.

12. What to write in your intro email to the landlord. What not to write in your email.

Here is an example of WHAT NOT TO WRITE. This is an example of a letter that will be rejected by a landlord or will be ignored.

“Hello, We are Polina (28) and Serguey (30) from Ukraine. We hav no job but we are looking. Can rent your place now?”

Imagine YOU are the landlord, what would you think of this? This is an actual email that someone has written to a landlord.

- No information about themselves, nothing about their character or their habits

- No job (warning sign)

- From Ukraine (warning sign – many people do NOT want refugees or new immigrants in their rentals as they think they are unreliable and aren’t financially stable. Yes, it is unethical and even racist to reject people based on their situation and country of origin, but it happens).

- Spelling/Grammar mistakes (potential communication issues). Use Google Translate or ChatGPT or ask a native-English speaker to look over your letter.

- Demanding tone (using “can” instead of “could”, no “please” and no “thank you” – the landlord already thinks that you are rude). You have to understand the Canadian cultural nuances and respect them.

How can we improve this application letter?

“Hi there, We are interested in renting your property. The location is perfect and the view from the balcony is very nice! We are a professional couple in our late twenties. We would like to find a place to rent for one year or longer. We are responsible, quiet, clean tenants and pay our rent/bills on time. We don’t drink, smoke, party or do any recreational drugs. We don’t have any kids or pets and are not planning on having them anytime soon. We are fine with providing 2 months of rent payment in advance. We’d appreciate it if you could please get back to us. We’d like to book a viewing appointment at your earliest convenience. Thank you for your time and consideration! Best Regards, Polina and Serguey “

- “Hi there” or “Good afternoon/Good evening” – these greetings are better than “Hello or Hi or Dear Sir/Madam”.

- They commented about a rental that’s very unique to the property. This shows that they didn’t just copy and paste their application message, and customized it to this particular property.

- They are a professional couple

- They want a long-term rental

- They are describing their character

- They don’t have bad habits

- They don’t have kids and pets (which means less damage and less dirt for the landlord)

- They are willing to pay rent in advance

- They are polite and not demanding

- They thanked the landlord for their time

These are all the things landlords are looking for. Nothing was mentioned about their job, so the landlord will be curious to find out about their situation. If the landlord asks them about their job, here is what they should write:

“We have applied for permanent full-time positions within our desired field, and are in the process of waiting for acceptance from the employer. OR YOU CAN SAY: We have applied for permanent full-time positions within our desired field and are in the process of waiting for interviews. We have savings and Government assistance (we are refugees from Ukraine), and we would have no issues paying you rent on time and in full. Having a stable home is a priority for us. We will treat your property with the same respect we would treat our own home. We appreciate you considering us as potential tenants. If you have any other questions, please let us know. Thank you!”

Another version (for one applicant):

“Good afternoon, I am interested in renting your property. I am a 26-year-old professional with full-time permanent employment in Calgary. I can provide confirmation of income and employment if necessary. I am looking to rent for 1 year or longer. I am a responsible, quiet, clean tenant, and I pay my rent/bills on time. I don’t drink, party, smoke or do any recreational drugs. My wife will be joining me eventually in 4 months. I don’t have any kids or pets. I work most of the time for a moving company. I’d appreciate if you could please get back to me. I’d like to book a viewing appointment as soon as possible. Thank you for your time and consideration! Best Regards, Sergey”

If you have kids or a dog

If you have a dog, you need to mention the weight of the dog in pounds (lbs) (NOT KILOGRAMS!!) and the pleasant demeanour of your dog. You don’t need to mention the age of the dog unless you are asked directly about it. Having a puppy or an older dog is not the ideal scenario, so that’s why you don’t need to mention their age.

We have a well-behaved, clean, quiet and friendly 8lb Pomeranian dog that will be staying with us in the apartment.

If you have a child/children, you need to mention their ages and how well-behaved and calm they are, and that they would be away for the majority of the time (less damage/noise for the landlord):

We have 2 children: our son Maxim (7) and daughter Julia (5). They are wonderful, well-behaved, respectful kids. We raised them with a strong belief that you have to respect the place you live in. They are calm and well-mannered and would be away in daycare/pre-school/kindergarten/doing activities most of the time.

13. Read and understand your lease.

You need to read or translate the Tenancy Act using Google Translate. You also need to understand the differences between month-to-month and FIXED tenancy. Most rentals online are FIXED tenancy meaning that you CANNOT decide to leave the rental place in the middle of your term (for example, 6 months early). You have to stay until your lease expires in one year.

If you are in a fixed 1-year lease and you need to leave, you need to talk to your landlord and see how they react. You will either have to pay them for the remainder of the year or find them a replacement tenant, or you have to pay a fee for breaking the lease. If you decide to leave anyway, your landlord will sue you, and you will have legal and financial problems and a negative landlord reference.

- Read the tenancy act – understand when your tenancy ends.

- Don’t paint or renovate the rental property without permission

- You must sign a contract, take pictures of the unit and email them to the landlord, save that email

- The landlord should do the move-in and move-out inspections in order to return the deposit.

- Never accept an apartment without a written contract!! If someone is hosting you for free, that’s Okay. If you are paying any money for it, you need a contract.

- The Landlord is NOT allowed to enter the premises without a 24-hr notice.

14. Important Note about Repairs in your Rental Unit

If something breaks in your rental, for example, if your faucet starts leaking or your dishwasher suddenly stops working, and it’s not your fault—in other words, you didn’t break it, it just stopped working on its own—then you are NOT responsible for paying for the repair. Instead, your landlord, who owns the property, is responsible.

For instance, if something in the apartment breaks due to normal wear and tear, you are NOT the one who pays—the landlord covers the cost, finds someone to fix it, and pays for the repair out of their own pocket.

However, if you accidentally break something yourself, like if your children were playing too roughly and broke the closet door, then it is YOUR responsibility to fix it. I would recommend informing your landlord that your children accidentally broke the closet door, but that you are willing to cover the cost of repairs, and then you would arrange for it to be fixed yourself.

Do you see the difference? If you are responsible for the damage, you have to cover the repairs. But if something breaks on its own, like a dishwasher, washing machine, or dryer failing due to no fault of your own, then the landlord is responsible for fixing it. So quickly get in touch with the landlord or the property management company that’s managing your rental unit.

15. What to do after you’ve found your rental property (next steps).

After you’ve found your rental place, it’s important to work on building your credit history and saving some money for the down payment for your future home. If you would like to get a head start and learn about how to get the best credit and start learning how to buy your very first home in Calgary, you can read my articles here:

- First-Time Home Buyer’s Guide: How to buy a house in Calgary

-

The Best Credit Score Guide for Canada: How to Get a Good Credit Score

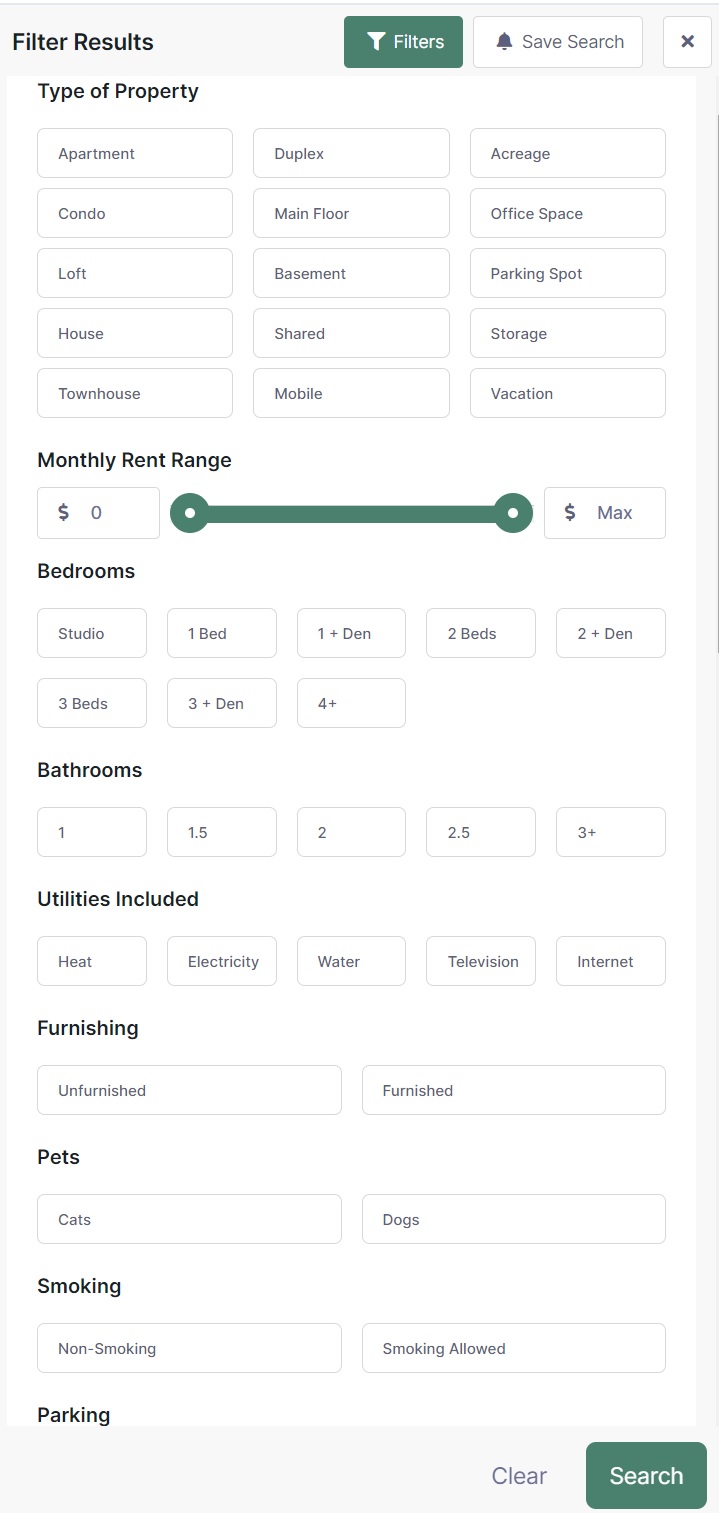

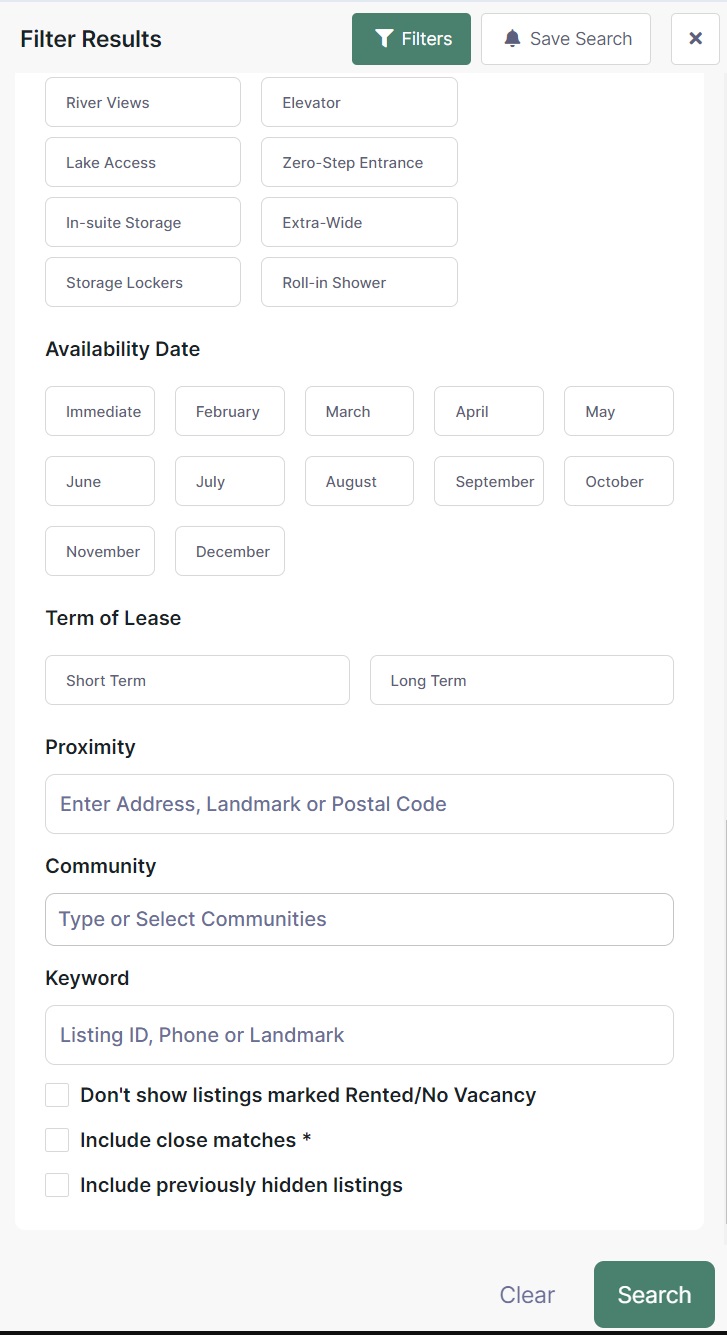

16. Tips on how to search on rentfaster.ca.

Rentfaster.ca has an excellent filter system that you need to use to narrow down your search. You can choose furnished/not furnished, pets allowed or not allowed, short-term rental or long-term rental, availability ( available immediately or next month or a certain month), etc.

I would recommend keeping your search very simple, as you don’t want to limit the number of listings you will be shown. Choose the type of property you want and the maximum amount of bedrooms you need. If you have pets, you should choose the properties that allow pets.

Make sure to check which utilities are included. Please see two examples below:

Do you have questions on how to buy your first home?

I do not help with finding a rental, unfortunately. I only work with buyers, sellers and a limited number of landlords who want to rent out a higher-end property in Calgary. I am a licensed real estate agent/Realtor and a property manager with CIR REALTY in Calgary, Alberta. I’ve been in real estate since 2011. Learn about me here.

If you want to get more information quickly and save yourself some time and effort, just send me a message, book an appointment with me (office or Zoom) or send me a text message – 403.835.6913 (I do not always pick up my phone as I am busy with clients, so for the fastest response, it’s better to text me or schedule an appointment online), and I’d be happy to help you figure out the best type of property in Calgary for you and your family.

If you are curious about what’s on the Calgary real estate market right now and want to know about interesting and fun Calgary events, sign up for my “Calgary Weekly Events in Your Inbox” here: http://bit.ly/yyceventslist