Welcome to our comprehensive update on the current state of the Calgary real estate market. In this analysis, we will navigate through the intricate dynamics that define the real estate landscape in Calgary.

For both seasoned investors and prospective homeowners, this update offers valuable insights to inform strategic decisions in the ever-evolving Calgary real estate market. Join us as we delve into the latest developments and shed light on the factors influencing the industry and the Calgary economy.

Quick Summary:

Interest Rates

- According to Canada Mortgage and Housing Corp., “In the first half of 2023, more than 290,000 mortgage borrowers renewed their mortgage with a chartered bank at a higher interest rate: from 5.45% for a 5-year fixed rate to 7.38% for a variable rate.

- Moreover, in 2024 and 2025, approximately 2.2 million mortgages are expected to experience an interest rate shock, constituting 45% of all outstanding mortgages in Canada. The majority of these borrowers secured their fixed-rate mortgages at historically low interest rates, likely around the peak of housing prices in 2020-2021 as per CMHC.

- As a practical example provided by CMHC: for a $500,000 mortgage with a five-year fixed-rate term and 25-year amortization, an interest rate increase from 1.94% to 5.45%, which would lead to nearly a $1,000 increase to the monthly payment.

Will the interest rates decrease in 2024?

Yes, they will but you will need to wait until mid-2024. According to Nesto.ca, the forecast for Canada’s mortgage rates suggests a rate hold until at least mid-2024, with some projections hinting at a possible rate cut during the March or July announcements. Despite consensus among the Big 6 Banks that interest rates may not decrease in time for the spring lending season (February to April), there is an expectation of a downward trend later in the year.

Credit: Nesto.ca

The specific timing and extent of these rate decreases vary in predictions, with the understanding that these forecasts are subject to change based on geopolitical and macroeconomic conditions.

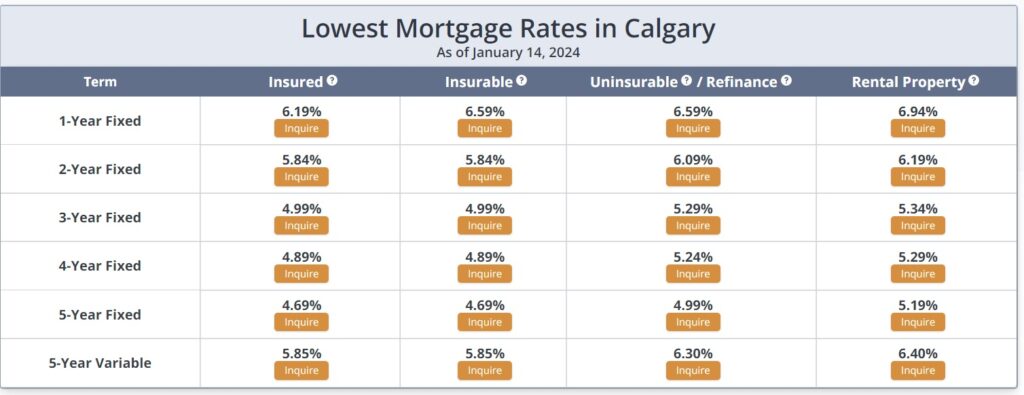

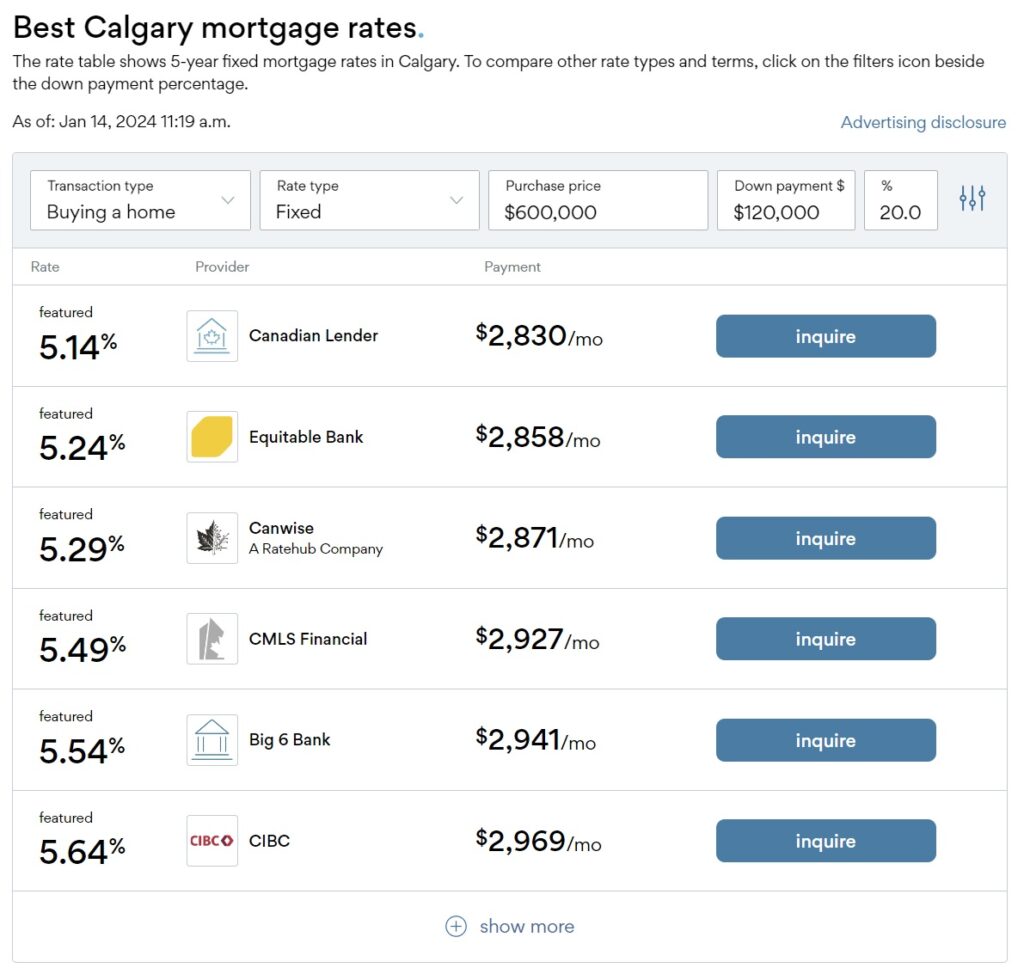

What are the mortgage rates in Calgary right now (January 2024)?

Detached Homes in Calgary

Detached Homes in Calgary

- In 2023, the detached housing market faced a significant sales decline of almost 20%, with the lower price range experiencing limited supply choices, leading consumers to explore alternative housing styles.

- Despite some improvement in sales for homes priced above $700,000, the market struggled with near-record low inventories and consistently low months of supply throughout the year.

- The persistently tight market conditions contributed to further price growth for detached homes, though at a slower pace than the previous year.

- On average, the benchmark price increased by nearly 8% percent in 2023, with the most substantial gains observed in the city’s most affordable districts.

Semi-Detached Homes (Duplexes) in Calgary

- In 2023, the semi-detached housing sector faced a 10% decline in sales compared to the previous year, despite some growth since May not fully offsetting earlier pullbacks.

- Sales downturn was notable for homes under $500,000, while higher-priced properties experienced improved sales. Limited supply choices in the lower range were a key factor in the decline.

- Persistently tight market conditions led to a general upward trend in prices throughout the year.

- On an annual basis, the benchmark price for semi-detached homes rose by 7% percent, marking a slower gain compared to the 12% reported in 2022 but still showing relative strength.

- Price growth varied, with the city centre experiencing a low of 6% percent, while the east district saw an impressive increase of over 16% percent.

Townhouses in Calgary

- In 2023, limited supply choices in lower price ranges led to a decline of over 11% in annual sales, despite increased sales for homes priced above $400,000.

- New listings improved in the second half, but gains were concentrated in higher price ranges, resulting in more balanced conditions at the top and a sellers’ market at the lower end.

- Seller-friendly conditions prevailed, supporting an annual benchmark price gain of over 13%.

- Prices improved across districts, ranging from 11% in the city centre to impressive growth of over 20% in both the North East and East districts.

Apartments

- In 2023, apartment-style properties were the star performers, reporting a record-high gain in sales at 7,884, fueled by higher starting inventory levels and increased new listings.

- Despite a positive start, market conditions tightened over the year, favouring sellers and driving up prices.

- Apartment condominium prices rebounded from their 2014 high, surpassing those levels and reaching a new record high of $321,400 by December.

- On an annual basis, the 2023 benchmark price for apartment-style properties surged by over 13%, marking a faster pace of growth compared to the previous year.

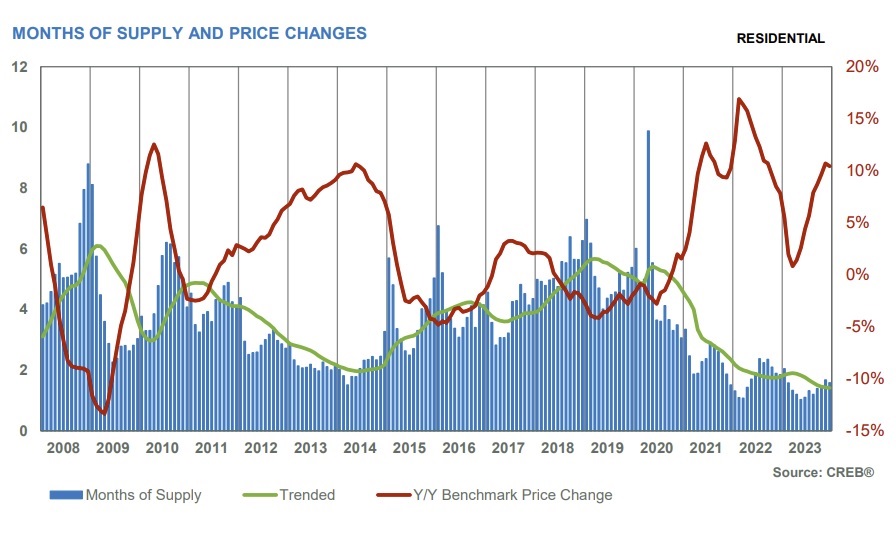

Months of Supply and Price Changes in Calgary

Regional Market Update

Airdrie

Do you have questions about buying or selling your home?

I am a licensed real estate agent/Realtor and a property manager with CIR REALTY in Calgary, Alberta. I’ve been in real estate since 2011. Learn about me here.

If you want to get more information quickly and save yourself some time and effort, just send me a message, book an appointment with me (office or Zoom) or send me a text message – 403.835.6913 (I do not always pick up my phone as I am busy with clients, so for the fastest response, it’s better to text me or schedule an appointment online), and I’d be happy to help you figure out the best type of property in Calgary for you and your family.

If you are curious about what’s on the Calgary real estate market right now and want to know about interesting and fun Calgary events, sign up for my “Calgary Weekly Events in Your Inbox” here: http://bit.ly/yyceventslist